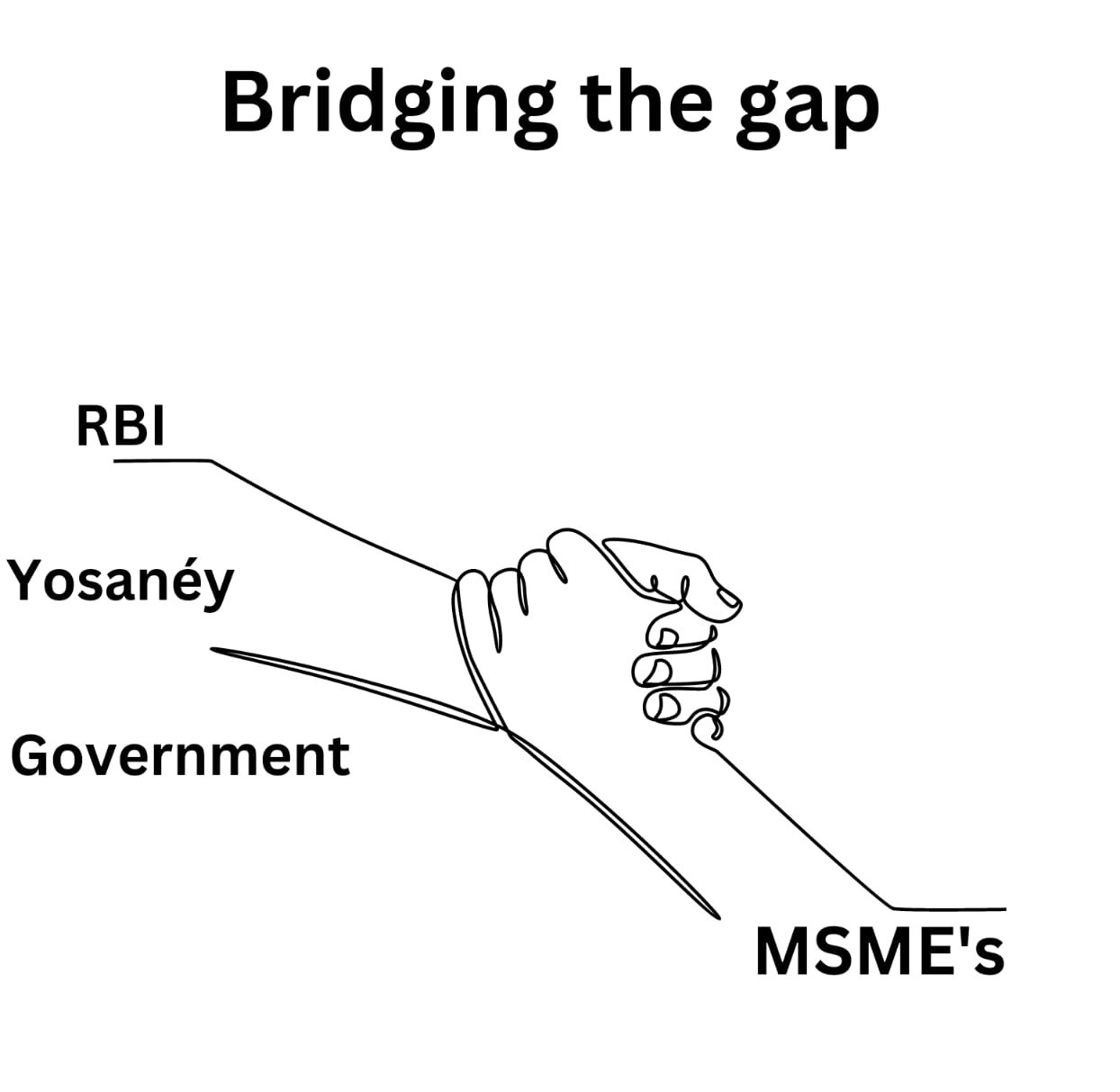

Yosaney, which translates to “thought” in Tamil/Kannada/Telugu and Hindi, is used colloquially as the opinion that emanates from a thought or the thought itself. What we do to with our clients cannot be better described! In our opinion, to Consult or Advise refers to the client in third person and breeds a culture of disassociation. We believe in an inclusive full-stack approach.

We are striving to be the best treasury management firm that will help our clients on matters impacting money. While there are multiple virtual CFO firms, our differentiator is to start with money at the core with finance, tax, secretarial & strategic expertise as manifestations of optimizing money for our clients. We value the longevity of money in a firm with financial stability, statutory compliance and risk management being the core pillars driving our delivery.

Our ‘Yosaney’ has been distilled over 100 years of experience across partners, yet humble enough to acknowledge that our duty is to provide the right perspective to MSME clients while respecting their competence. We believe there is significant value in benchmarking clients to the best practices amongst their peers and we are just the messengers of it.